Garry Moratti was diagnosed with an “incurable” and deadly workplace illness. But there’s a shocking reason he’s been denied a payout.

When Queensland stonemason Garry Moratti was diagnosed with silicosis in 2017, the message from his doctor was clear – either give up work or die.

So Mr Moratti was forced to abandon the career he had enjoyed from the age of 15 as he battled the lethal lung disease, which has left him with a life expectancy of just four to five years.

But while the incurable workplace illness – which is becoming increasingly common among Australian stonemasons – is horrendous enough, Mr Moratti and his family have also been dealt another blow.

Mr Moratti is a Sunsuper member, and he assumed he would be eligible for total permanent disability (TPD) insurance, which is usually a lump sum payout awarded to a client who has been permanently disabled and is unable to work again.

But earlier this year he learned the company had switched to a “drip feed” policy in 2016, meaning eligible clients now receive six instalments across six years instead of one large payment.

Sunsuper is the only insurer in the country with this policy, which drip feeds claimants and requires them to be continually assessed – even when their conditions are terminal.

Mr Moratti, who shared details of his illness on The Sunday Project last year, told news.com.au the situation was devastating, and that a lump-sum payment would help him enjoy the time he had left and help prepare his wife and three children for his death.

While the 51-year-old had $93,000 in total permanent disability insurance, Sunsuper’s policy means he is only paid in $15,000 instalments, made worse by Mr Moratti not having income protection insurance.

He said the policy was “ridiculous” and “cruel” and urged other Sunsuper members to “triple check” their own policies.

“How can they be the only company that does this?” he said.

“My stress levels have gone through the roof and since being diagnosed, mainly because when I do go, I want to know at the back of my mind that my family are set – but I can’t do that because of this drip feed policy.

“It’s just not fair. It’s my money.”

A Sunsuper spokeswoman confirmed in a statement Mr Moratti was not eligible for a lump-sum payment.

“Total and permanent disability assist is a policy that offers protection and ongoing support to members if they were to become permanently disabled,” the statement reads.

“In early October 2019, Mr Moratti’s total and permanent disability assist claim was assessed and approved by Sunsuper and the first annual payment (first of six across five years) was made in late October 2019.

“Mr Moratti’s medical condition does not meet the conditions for a single lump sum benefit payment under the terms of this insurance policy.

“As a profit-for-members fund, our sole purpose is to act in the best interests of our members, and we will continue to support Mr Moratti under the terms of his insurance policy into the future.”

But Melissa O’Neil, Shine Lawyers superannuation insurance expert, told news.com.au she had “never seen anything as absurd and unfair” as this Sunsuper TPD assist policy.

“How can someone diagnosed with a terminal illness not be entitled to their total and permanent disability payment in full when they have worked tirelessly and contributed to their super fund for decades to cover them for exactly this sort of unexpected illness?” she said.

“It has been a devastating double blow for Garry and his family who are doing it incredibly tough financially while also trying to process the fact that Garry suddenly has a life expectancy of four to five years.

“All he wants to do now is enjoy the time he has left with his family, but instead he is suffering extreme psychological distress trying to work out how he can provide for his family.”

Ms O’Neil said she believed Sunsuper had “failed in its obligations to act in the best interests” of clients, and said there were likely thousands of other Australians who had the same policy without realising.

“As part of this ridiculous policy Garry is being drip fed small annual payments, and there is no certainty as to whether the next one will actually be paid – he has to reapply and be reassessed. For a fellow with a terminal illness, this is just insanity,” she said.

“This poor fellow has silicosis. He should be receiving the money in full and left alone with some financial certainty to enjoy what time he has left with his family.”

However, Mr Moratti isn’t the only Australian to be stung by this policy.

Last year, news.com.au spoke with former boilermaker and Sunsuper member Glenn Dickson, who was also denied a lump-sum payment even after losing a leg in a horrific shark attack.

According to Mr Dickson, Sunsuper’s policy meant he “couldn’t afford a wheelchair”, a decent prosthesis or other medical bills, let alone modify his home to make it disability-friendly.

WHAT IS SILICOSIS?

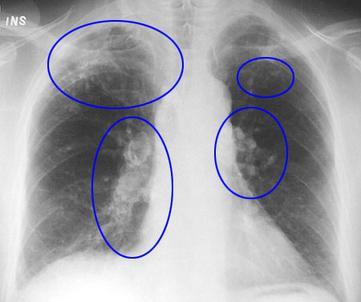

The progressive, irreversible lung disease is caused by long-term exposure to silica dust, which is created when artificial or engineered stone is cut.

Symptoms can include shortness of breath, cough, fever, cyanosis (bluish skin) and frequent chest infections that can eventually lead to lung transplants and death.

While silicosis deaths are dropping globally, there has been an alarming spike in cases among Aussie tradies believed to be linked to cutting engineered or artificial stone products used to make kitchen benchtops.

The toxic dust has been dubbed “the new asbestos”, and a 2017 Queensland Parliamentary inquiry into coal workers’ pneumoconiosis (black lung) was told silica was “more dangerous than coalmine dust”.

The condition is so devastating the Queensland Government ultimately banned the dry-cutting of engineered stone benchtops, which exposes workers to the illness.

If you are concerned about silicosis and are based in Queensland, where the majority of cases have been diagnosed, contact WorkCover on 1300 362 128 to arrange a health screen.

Source here:https://www.news.com.au

Frequently Asked Questions

Yes, you can. If you’re diagnosed with a serious cancer that has an impact on your ability to work, you may not realise you are entitled to claim insurance benefits through the insurance provided through your superannuation. These benefits may include income protection if your disablement is temporary, and TPD if your condition is long-term and serious. If your condition is terminal, you will be eligible for a terminal illness payment.

Yes, you can. People are now becoming more aware of depression and other mental illnesses, and while there’s a way to go before the stigma is lifted, we’re talking about it more often. Around one in four Australians suffer from a mental illness each year. However, insurers are wary of mental illness disability claims, and it can be quite hard to get cover. But what many people fail to recognise is that the automatic TPD insurance you have through your superannuation fund can pay out much-needed benefits and funds if you cannot work due to depression or any other mental illness.

Mental illness can often be a lingering side effect of a physical injury, even after full physical recovery.

Yes, you can have multiple TPD claims providing your insurance policies or super funds are independent of each other. Bear in mind that, unlike other personal injury claims, when you make a TPD claim, you do not have to prove that the illness or injury was work-related or caused by somebody else.

A successful TPD claim can never be 100 per cent guaranteed, but you are much more likely to win your claim if you contact a TPD specialist lawyer at PK Simpson to discuss your situation. There is a minimum level of evidence required to support your claim, which must be provided to your insurer and your super fund. This includes your claim form, a signed authority, certified ID, and two medical reports from your treating doctors showing that you can never return to work. These will need to be reviewed by a lawyer to ensure all the correct boxes are ticked, and that the evidence strongly supports your claim for TPD.

Often, terms and conditions specific to your policy need to be analysed in order to make sure the fund cannot decline your claim.

Superannuation funds will often require specialist reports. Superfunds do not pay for treatment throughout the claims process. However, PK Simpson pay for all medical reports needed to support your claim.

Most claims are paid out and finalised within three to six months, but it all depends on how complicated the claim is, and how much good evidence you have about your injuries. There is also the matter of whether you fulfil all the criteria set by your insurer. This is why it’s crucial to have a specialist TPD team on your side when you make a claim for TPD for any reason.

As lawyers we will make sure your claim is assessed by the superfund in a timely manner. Delay tactics are deployed by funds to prolong and frustrate TPD claimants who are not legally represented.

If you haven’t been able to work in your usual job for three to six months due to an injury or illness, you are likely to be classed as TPD.

Each superfund has their own TPD definition and this must be satisfied for the TPD claim to be approved. Common factors which are assessed in each claim are the members work history (education, training and experience), suitable jobs, and medical evidence.

Your TPD entitlements are set out in the contract (a.k.a. policy, or product disclosure document) you have with your insurer. Therefore, the definition of TPD will vary between policies and insurers.