Claim

The laws covering motor accident compensation changes regularly so you will need an expert lawyer who is abreast of these to fight your case. If you’re one of the lucky few who never have to claim on their insurance, you’re fortunate indeed. But accidents do happen, things tend to go awry, and usually at the worst possible times. If you’re involved in a natural disaster, a vehicle accident, or other event where you or a loved one is injured, or you suffer a loss covered by your insurance policy, you can make a claim.

What kind of compensation can I expect?

![]()

Pain and suffering

Future Economic Loss

Wages Lost

When you buy an insurance policy, your insurer promises to provide assistance if your injuries, loss, or damage is covered by the policy’s terms and conditions. To activate your insurer’s response, you must make a claim, and if the claim is accepted, as most are, the policy’s promise will be granted. This is usually through replacing or repairing damaged items or property, paying all medical and legal costs incurred, and paying you adequate compensation. But it’s crucial to your success to get legal advice before lodging your claim. Consult one of PK Simpson’s specialists to ensure there are no hitches or delays in receiving your compensation.

For more than 38 years, PK Simpson Injury Compensation Lawyers have been helping the people of Australia claim and receive the compensation they deserve.

We’ve successfully handled over 25,000 claims and helped thousands get their lives back on track.

That is our speciality!

What Should I Do Before Making a Claim?

If you’re involved in a serious motor accident and will need to make a claim on your insurance or someone else’s if you’re not at fault, you must follow the steps below:

- Call the Police: If the police did not need to attend the accident scene, you must get the details of any other vehicles involved – names, addresses, car registration numbers – then go to the nearest police station and report the accident, or within 28 days, phone the Police Assistance Line on 13 14 44. Call PK Simpson lawyers for advice and assistance. You will need an incident number for your insurance claim.

- Submit your Accident Notification Form. You must submit this form within 28 days of the accident, whether you were the driver at fault or not because there are no extensions on the time to lodge the form. You must also make sure a medical certificate signed by your doctor is attached to the form.

- Submit a Motor Accident Personal Injury Claim Form. In an accident where another person was partly or wholly injured, you must submit a Motor Accident Personal Injury Claim Form with your CTP inside six months of the date the accident if you were at fault. If you were not at fault, then the form must be submitted with their CTP insurer. This form is rather complicated and long, so consult a lawyer for help.

It’s a good idea to check your comprehensive insurance policy to make sure there are no exclusions that might affect your claim, and if you don’t know what your excess amount is, then check that as well. Your lawyer can help in lodging your claim with all the correct documentation and medical records of your injuries or details of your property damage or loss.

What is the Process of Making a Claim?

There are hoops to jump through when making an insurance claim, but most insurance companies generally try to make the process run smoothly. The secret to success is to make sure you are organised and well prepared and have as much documentation and information as possible to show the insurer. Although the different insurance companies have their own ways of handling claims, those who are members of the Insurance Council of Australia(1) are required to follow the set standards found in the General Insurance Code of Practice(2) for handling claims.

Things to consider:

- Whether the accident was your fault or not, you may be entitled to compensation.

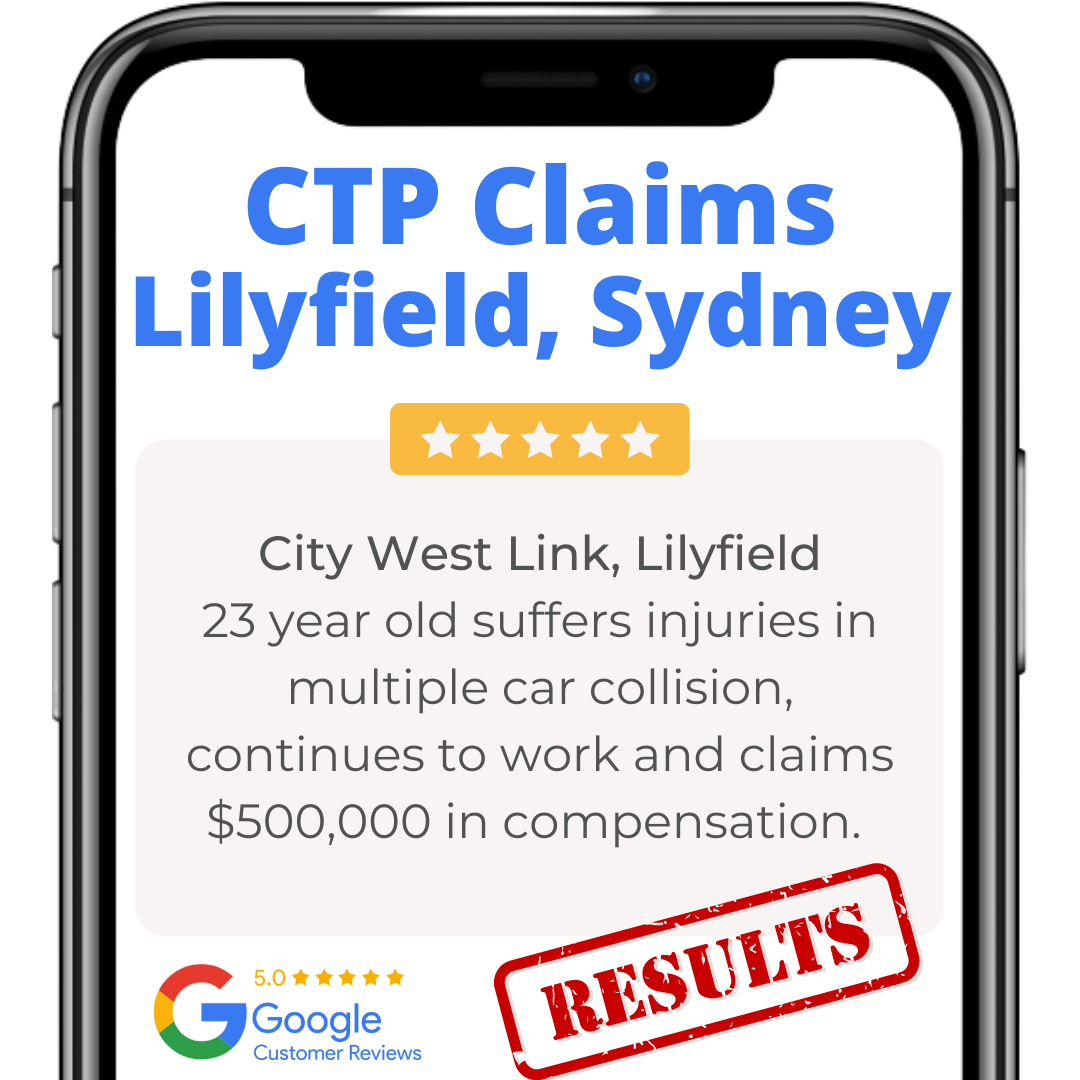

- CTP policies are now issued by only four insurance companies (Allianz, NRMA, QBE and GIO/AAMI). They all have teams assigned to every claim, and their task is to keep compensation payouts to a minimum.

- In claims involving any type of vehicle, passengers, drivers, cyclists, pedestrians, motorcyclists can claim even if the accident was not on a public road.

If you don’t know if the at-fault vehicle was unregistered or uninsured, you can still lodge a claim against the Nominal Defendant.

At PK Simpson, we represent anyone with a viable compensation claim, whether large or small, arising from injury or illness suffered as a result of:

Motor Vehicle or Workplace Accidents – Inability to work due to injury or illness – Public or Private Place Accidents – Whole Injury Damages Claims (Common Law Claims) – Medical Negligence and TPD

What Can I Claim?

While damages may be paid in a lump sum, some payments may be made before your case is finalised as set out below:

- Financial Hardship: If your insurer admits liability and you’re suffering a loss of wages which puts you in financial difficulty, you can claim early compensation for economic loss.

- Medical Expenses: Providing your insurer admits liability, you can claim your reasonable medical expenses immediately, plus all future costs.

- Care and Domestic Help: If due to an accident you need help at home, or if you can no longer care for someone else, you may be able to claim for such past and future losses.

- Loss of Income: You can claim for lost income if you can no longer work due to an injury caused by an accident, or if you’re likely to lose future income.

- Minors and Catastrophic Injuries: There are special compensation laws covering children under 16, and if they suffer very serious injuries they can claim benefits under the Lifetime Care and Support Scheme, no matter who was at fault.

- Pain and Suffering: If you have sustained a permanent injury and it passes a 10 per cent whole person impairment threshold, you can claim more compensation for your suffering, impairment, and loss of enjoyment of life.

How Long Do I have to Wait for My Claim’s Assessment?

Insurance companies have to abide by the General Insurance Code of Practice, which means they should respond to your claim within 10 business days and advise you whether they accept your claim or not. If you insure wants to appoint a loss assessor, adjuster or an investigator they should give you a time frame of when a decision will be made on your claim and if it is complex, your insurer will negotiate with you to arrange another deadline for assessment. If your insurer denies liability and blames you that is not the end of the matter because it can be overturned by the court. You should contact your PK Simpson lawyer should any disputes arise in a claim, or preferable, allow your lawyer to handle the claim from day one.

PK Simpson prides itself on being a firm that can help you with any claim for compensation, whether it is a large claim or a small one. Call us today or enquire online now so we can help you. Phone us on 1300 757 467 or email enquiries@pksimpson.com.au.

References:

- http://www.insurancecouncil.com.au/

- http://codeofpractice.com.au/

Frequently Asked Questions

If you’ve had a motor car accident, stop your vehicle and turn on your hazard lights. Make sure nobody is injured, and if so, call emergency 000 and remain at the scene of the accident. If it’s a minor incident you don’t need to call the police, but move the damaged cars if possible.

Never admit responsibility even if you think you were at fault. Collect name, address, registration number and insurance details from the other parties and get witness details if possible.

If you’ve had a motor car accident, stop your vehicle and turn on your hazard lights. Make sure nobody is injured, and if so, call emergency 000 and remain at the scene of the accident. If it’s a minor incident you don’t need to call the police, but move the damaged cars if possible.

Never admit responsibility even if you think you were at fault. Collect name, address, registration number and insurance details from the other parties and get witness details if possible.

If you’ve had a motor car accident, stop your vehicle and turn on your hazard lights. Make sure nobody is injured, and if so, call emergency 000 and remain at the scene of the accident. If it’s a minor incident you don’t need to call the police, but move the damaged cars if possible.

Never admit responsibility even if you think you were at fault. Collect name, address, registration number and insurance details from the other parties and get witness details if possible.

If you’ve had a motor car accident, stop your vehicle and turn on your hazard lights. Make sure nobody is injured, and if so, call emergency 000 and remain at the scene of the accident. If it’s a minor incident you don’t need to call the police, but move the damaged cars if possible.

Never admit responsibility even if you think you were at fault. Collect name, address, registration number and insurance details from the other parties and get witness details if possible.

If you’ve had a motor car accident, stop your vehicle and turn on your hazard lights. Make sure nobody is injured, and if so, call emergency 000 and remain at the scene of the accident. If it’s a minor incident you don’t need to call the police, but move the damaged cars if possible.

Never admit responsibility even if you think you were at fault. Collect name, address, registration number and insurance details from the other parties and get witness details if possible.

7 out of 10 clients are referred by our current clients.

“I’m so happy to have found the team at PK Simpson. They helped me when I was going through one of the toughest times of my life. When my claim settled I ended up with a compensation payout which allowed me to keep my family home. Would recommend 100%”

“I have received the cheque and paperwork. Thank you very much! I really appreciate what you have achieved.”

“Thank you so much. I definitely will stay in touch. You always manage to help so thank you very much from both my father and I. We really appreciate your help and the whole team.”

“The very friendly team at PK Simpson has helped me complete three TPD claims. They have helped in all aspects from professional courtesy to contacting me in regards to appointments. I strongly recommend that you go with PK if you’re in need of any help.”

“I am very, very thankful to PK Simpson for helping me get my TPD claim approved. This has changed my life. All my debts are paid off. I still have funds to secure my future.A very special thanks to my TPD solicitor and secretary for all the help and follow up you did.”

“I have received your letter with attached cheque. I wanted to thank you for finalising my matter so quickly. It is very much appreciated. All the best to my TPD team.”

“Thank you so much I have gone through a lot. This will help me in a lot of ways physically and mentally. I’ve sent some flowers to show my appreciation.”